Enviant sale to One80 is latest liquidity event under Euclid’s partner model

The sale of environmental MGA Enviant to One80 Intermediaries by Euclid demonstrates the firm’s partner model, which allows for liquidity events as well as providing a platform for growth.

The deal for Enviant was revealed by Program Manager earlier this month, as Euclid sold the Houston-based MGA just under seven years after bringing it onto its platform in a move that expanded its capabilities into the environmental insurance market.

The firm offers a comprehensive suite of environmental products and services to a range of commercial clients, including environmental casualty, site pollution and contractor’s pollution, and professional insurance.

Speaking to this publication, Euclid Insurance Services (EIS) CEO John Colis said: “We continue to execute on our model – providing a platform for exceptional underwriters to do what they do best, free from organizational noise.

“Our job is to clear the playing field and allow our partners to focus on only one thing – creating underwriting value. Int he process, we get to be in business with the best talent in the industry. It’s a lovely way to make a living.”

As previously reported, EIS runs a partner model typically taking a 51 percent stake, with investing managers in the individual program administrators (PAs) or MGAs holding the rest.

It takes a long-term view on its ownership of the MGAs launched on its infrastructure, but also provides a platform for growth and potential liquidity events, if the owner-managers are looking to sell.

Euclid provides significant support in taking the start-ups to market to secure capacity from an insurance carrier, as well as helping with the negotiation of the agreement that governs the relationship.

It also provides administrative services such as accounting, IT and HR, freeing the owner underwriting teams up to focus on running the individual MGAs.

The MGAs it forms are typically set up as separate corporations.

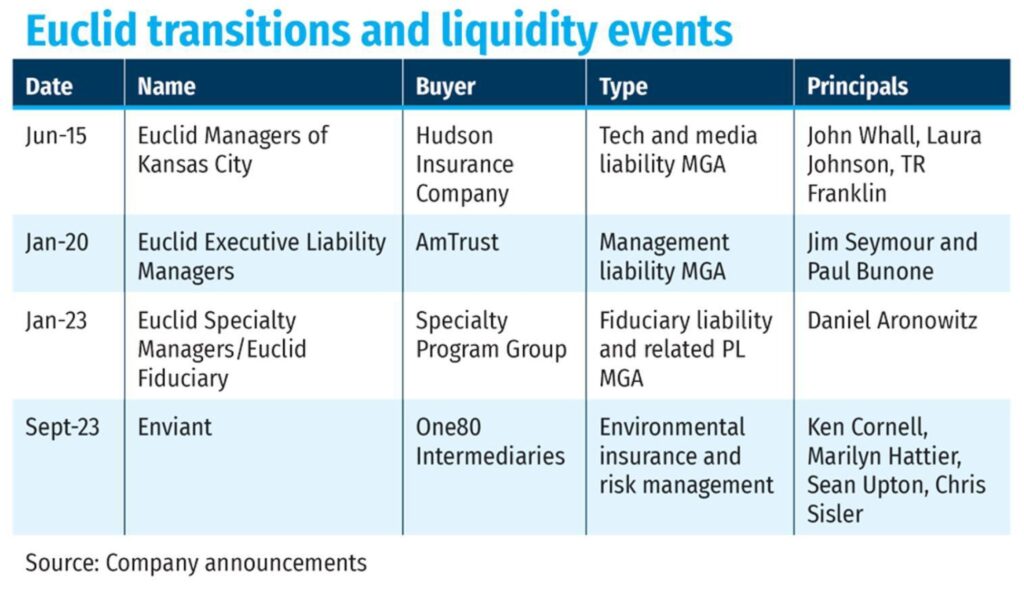

Liquidity events

The sale of Enviant is the second liquidity event for an MGU on the EIS platform this year, following the Dan Aronowitz-led PA Euclid Specialty Managers (ESM) to Hub’s Specialty Program Group in January this year.

EIS launched ESM with Aronowitz in 2011 to focus on the fiduciary liability segment, with the PA growing to more than $80mn of premium volume.

It specialises in providing fiduciary liability, D&O, employment practices liability, cyber liability and crime insurance coverages to employee benefit plans and plan officials on an admitted bases, writing on the A rated paper of Odyssey Group’s specialty insurance operation Hudson Insurance Group.

On the EIS platform, Aronowitz built a 15+ strong team including chief underwriting and strategy officer Michael Saa and chief underwriting and business development officer Justin Bove, as well as chief business officer John O’Brien and chief claims officer Jeffrey Koonankeil.

Prior to ESM, the last MGA to leave the platform was Euclid Executive Liability Managers, which was acquired by its carrier partner AmTrust in January 2020.

In October 2021, this publication revealed that Searchlight Capital had taken a minority interest in Euclid Transactional, but the M&A insurance MGA remains on the Euclid platform.

Enviant takes next step with One80

Enviant is led by managing principal Kenneth Cornell, who will now be a managing director with One80 and who previously worked with Aspen, Allied World and Crump following a long tenure at AIG. he said Enviant had “very much enjoyed” its collaboration with Euclid.

“Our partnership has served as a foundation for lasting success,” Cornell commented.

Marily Hattier, who also previously worked at Aspen, Allied World and AIG and has been Enviant’s chief underwriting officer, is joining One80 as a managing director as part of the deal as well.

“A seamless delivery of integrated solutions is the central tenet of Enviant’s philosophy,” Hattier said.

“We are confident that joining the One80 family will enable us to deliver market-leading environmental solutions at scale,” she added.

One80 president Matt Power commented that the Enviant acquisition adds to the expansive wholesale broking and MGA platform’s “robust environmental platform”.