Monaghan: Euclid Mortgage MGU aiming to seize on opportunity from rebounding housing market

![]()

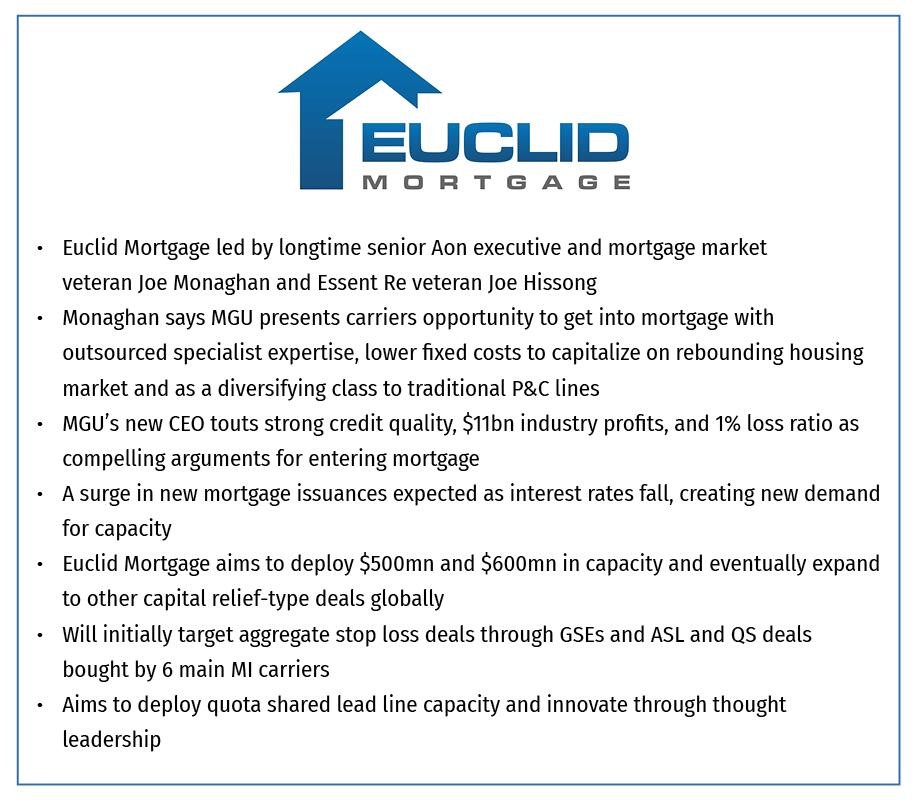

Euclid Mortgage’s newly-installed managing principal and CEO Joe Monaghan has said that the MGU is being set up to seize on an expected rebound in the housing market as interest rates come down and pent-up demand leads to more issuance.

The longtime senior Aon reinsurance executive made those comments in an interview with The Insurer, speaking alongside Euclid Program Managers CEO John Colis, as the pair detailed the motivation for launching the new venture.

Monaghan laid out two key pillars to the strategy, which in addition to benefiting from an expected rebound in the mortgage market, also plans to capitalize on the opportunity to bring more markets into the space as they seek diversifying classes away from more stressed P&C lines.

“The key here is it is about the opportunity,” Monaghan said, noting that he has worked in the mortgage (re)insurance space since joining Aon in 1998 when he was assigned a client in the segment.

“I was involved in the business very, very heavily years ago [and] got to see it through several different cycles,” he explained.

“Post-crisis, that’s when this market really, really developed and the opportunity that we see now is building on all of this success that’s happened over the last ten years,” he continued.

“The products in terms of what Fannie Mae and Freddie Mac are buying – what the mortgage insurers are buying – 10 years ago we were making them up, we were creating, we were developing, we were innovating,” Monaghan said.

Now, Monaghan said, those products “have become quite standard” as he pointed to $11bn in profits the segment has generated for reinsurers over the course of its history, to go along with a 1 percent loss ratio to make the case that the mortgage (re)insurance product has “been very successful”.

“If you look at the last 20 years, [the market is near] a low ebb in terms of mortgage originations, which has everything to do with where interest rates and the housing market are,” he commented.

Surge in issuances expected

Monaghan noted that the health of the mortgage market is expected to improve as interest rates come down, leading to a surge in issuance, a need for capacity, and more carriers looking to get into the segment and a need to outsource the specialist mortgage expertise.

“Because many homeowners don’t want to give up their current mortgage at 4 or 5 percent rates, they are not selling their homes. There’s not enough homes for sale,” he explained.

“The fundamentals for housing are strong. First and foremost, on the risk side, the credit quality is exceptional and has remained very, very strong since the financial crisis,” Monaghan continued.

The seasoned executive said that the strong credit quality in the market isn’t the result of “luck” and “it’s not an accident” as he pointed to “significant structural and legal changes that have created a much safer mortgage underwriting process”.

“That remains the case, and will remain the case. But the supply-demand dynamics are also very strong. There’s been a chronic undersupply of new homes being constructed since the housing crisis,” he elaborated.

Monaghan also pointed to a recent public comment from Freddie Mac saying that the US will need a million and a half new units constructed every year for the next three to four years just to keep up with demand.

Euclid Mortgage’s CEO couldn’t predict when interest rates would start to come down. But when they do, he expects mortgage issuance to surge due to pent up demand.

He also said that once those in the market get their arms around the opportunity – including the prospect of 20 percent returns and the extent of data and analytics tied to the segment that are available – they will recognize that mortgage is a compelling class to write.

“If people take the time to really understand it, it becomes less complicated to them from a macro standpoint, and they say, ‘Hey, this makes a ton of sense to my portfolio’ if I’m an insurance company or a reinsurance company,” he explained.

Specialist expertise of an MGU is critical

Monaghan then made the case that because of the high-level of expertise to write the business – including establishing mortgage credit models and then tying them into an internal ERM framework, managing PMLs and multi-year deals – mortgage risk is perfectly suited for an MGU.

“It’s a challenging undertaking, and you’re talking about significant investment of time, money and effort hiring new people to take their time to do it well,” he explained.

“And so as we looked at this, I said ‘good grief’ – a full-service best in class MGU that could be a turnkey [solution]” to make writing mortgage business easy for companies, creates real value, Monaghan said, as he explained how he and his team would take the time to educate industry c-suites and board members.

“You can get [into mortgage] with confidence,” Monaghan said, emphasizing his firm’s ability to work with (re)insurers on their risk appetite and the opportunity for an outsourced specialty mortgage underwriting operation to help them “get up and running immediately”.

Euclid also has another executive lined up to join the MGU whose identity could not immediately be disclosed, but has worked in the mortgage (re)insurance market for the last 35 years.

“You can establish scale and relevance, but less expensively – it’s less expensive to start with us than if you were to go out and hire people and build it up yourself,” he explained.

Euclid Mortgage plans to operate with anywhere between three and six carrier partners and work with those carriers on their individual risk appetites.

“But collectively, because they’re all part of Euclid Mortgage there’s scale, leadership and leverage, so you get the benefits of partnering with us – because we are representing many carrier partners – and we are a leading provider of capacity and a thought leader creating new solutions” he said.

Diversifying class for P&C (re)insurers

Monaghan said that those that partner with Euclid as new entrants can get into the class without having to take the risk of writing lead lines, while avoiding the fixed costs associated with hiring their own internal underwriting team.

“You don’t have to build the expense to be a leading market – you have access with us, which we think is a value prop that will really resonate with people,” he added.

Euclid Mortgage will underwrite aggregate stop loss (ASL) cover sought out by government sponsored entities (GSEs) Frannie and Freddie Mac as well as the six main mortgage insurers who buy both ASLs and quota share.

Monaghan is widely viewed to have been on track for increasingly senior leadership roles at Aon, but said he chose to make the move as an opportunity “to do something new and entrepreneurial” and that he received strong support from Aon leadership for the new venture.

Early exploratory conversations suggest that Euclid will attract capacity from a range of players, some of who have already operated in the mortgage space, and others looking to make an entry.

“There have been a few people that reached out to us that are maybe doing a subset of it now and want to look at other areas. Maybe they were just doing the GSE deals, they want to look at the MI deals,” he said.

Monaghan said he’s received outreach from some carriers who have been “dabbling” in mortgage and have done some deals on the margins and have the balance sheet to do more, but have lacked the confidence to do more deals without stronger in-house expertise.

Euclid’s CEO pointed to industry incumbents Arch, RenRe, Everest, Munich Re, PartnerRe, and Essent Re as big players already in the mortgage space.

“We want to be a leader as well,” Monaghan said, pointing to the opportunity to write lead lines with quota share backing as one significant opportunity for the nascent MGU, along with providing innovative thought leadership.

Monaghan spoke of a longer time horizon for scaling the business, with an aim to deploy $500mn to $600mn in capacity annually.

“That’s going to take us time to build out over the next three to four years, and even beyond that is our broader vision – mortgage is a great business, and it is our first focus getting this launched,” he said.

More than US mortgage risk can be transferred to insurance industry

“But we see opportunities in US mortgage beyond the existing buyers, and if you think about, for example, in Europe with the [significant risk transfer transactions] (SRTs), which are bank capital relief trades that have principally been executed with hedge funds, pension funds,” he pointed out.

“Insurance is starting to play a bigger role in that,” he continued.

“We think there’s an opportunity for reinsurance and insurance companies to provide capital relief to many different types of financial institutions for asset classes, including mortgage in the US, Europe and in Asia,” he added.

The initial focus will be mortgage, but eventually, Euclid Mortgage can play a role in providing capital arbitrage to financial institutions that are subject to different regulatory capital frameworks.

“There’re good reasons that there are different capital frameworks. It’s not smoke and mirrors. These are different businesses based on different risks, and it could benefit all parties involved in transferring some of the credit risk on those assets to insurers where they don’t currently have a significant amount of exposure to those types of assets,” he explained.

“That’s good for the whole ecosystem. It makes the whole system safer. It creates diversified sources of profitable business for the insurance industry, and it creates efficient capital and risk transfer for the banking industry,” he added.

“And we see more and more opportunities over the next several years to grow,” Monaghan said.