Target Markets – Program Business Landscape And The TMPAA’s Dynamic Evolution

The expansion of the program marketplace is mirrored in the status and growth of the only association dedicated solely to program business. Presently, the Target Markets Program Administrators Association (TMPAA) boasts a membership of 622 entities, encompassing 360 program administrators, 87 carriers, and 175 service providers.

Despite challenges, program business continues to experience incredible growth, with unique risks in their businesses.

Projections indicate that the premium within this sector is poised to surpass 80 billion dollars. This precise figure will be unveiled in October, coinciding with the presentation of the TMPAA State of Program Business findings at the association’s 23rd Annual Summit in Scottsdale.

The growth trend extends to association events, with a consistent 15% year-over-year rise in meeting attendance following the resumption of events after COVID-related cancellations. Projections for the upcoming October Summit suggest a gathering of nearly 1,500 program business professionals.

As growth burgeons, fresh initiatives have arisen under the guidance of the TMPAA Advisory Board, aimed at addressing the evolving requirements of the collective.

A focal point of the Summit’s panel discussion, “From Potential to Powerhouse–Developing Emerging Talent,” revolves around the challenges that numerous TMPAA members encounter in recruiting new, skilled individuals. The panel will serve as a conduit for connecting association members with risk and insurance programs in colleges and universities nationwide, commencing with the scholarship recipients already endowed by TMPAA Charities.

Substantial investments and enhancements are also in the pipeline for Target University and the Certified Programs Leader (CPL) professional designation. The blueprint includes renovations

to university facilities, slated for next year.

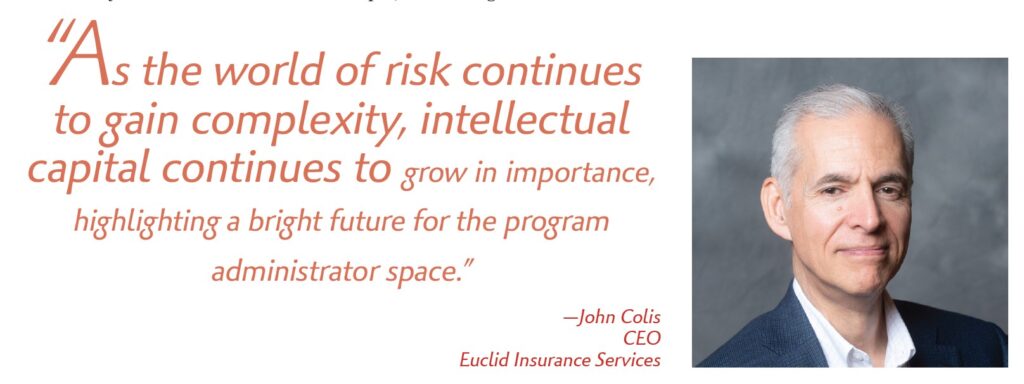

Another development in 2024 will be the transition of leadership within the Advisory Board. John Colis, CEO of Euclid Insurance Services, will step down from his role as TMPAA President, passing the baton to Tom Gillingham, managing director of NFP.

These leaders play a pivotal role in charting the course for TMPAA. Following is their evaluation of the state of program business and the TMPAA.

From John Colis

As we move through the second half of 2023, program specialty growth continues apace, bringing with it an intriguing, if uneven, marketplace. This cycle resists a one-size-fits-all label.

Cat-exposed property business finds itself in a generational hard market with no “class of 2023” in sight. Climate uncertainty most definitely plays a part in the want of capacity. Ever-rising value accumulation in coastal and wooded areas contributes, as well.

Many are simply waiting to see how the 2023 storm season plays out. We are an industry of numbers, but also emotions.

While their property cousins search for capacity, certain casualty lines, notably management liability, have seen scores of new entrants, which have pushed this market into a price spiral. D&O limits written are increasing as prices drop, all in the context of rising social inflation. What could go wrong?

Against this market backdrop, formations of new program administrators continue at a strong pace. The traditional insurance company model was always a union of financial and intellectual capital. The MGA model allows these resources to be bifurcated, freeing up the intellectual property portion of the equation to operate in a nimble and flexible way. As the world of risk continues to gain complexity, intellectual capital continues to grow in importance, highlighting a bright future for the program administrator space.

As 2023 moves to its conclusion, a final observation involves the intersection between rising interest rates and MGA valuations. Many wondered whether valuations would drop as the cost of capital increased. Yet, as the year progresses, this has not happened in a material way.

The best that can be said is that slower-growing entities are realizing a bit less than they might have 12 months ago. Strong players, however, are as popular as ever, with many suitors awaiting their attention. MGA formation will remain strong because MGA demand remains strong—all to say that the future promises to be quite interesting in our space.

From Tom Gillingham

In an industry growing and evolving as rapidly as ours, it’s reasonable to expect some turbulence along the journey. The year began with many leading macroeconomic indicators pointing towards a recessionary environment in the United States, as the Fed undertook an historic, tightened cycle and the economy cooled.

Against the backdrop of several successive years of aggressive industry consolidation, favorable underwriting conditions, a burgeoning insurtech industry, and access to a growing field of alternative capacity providers, guessing where to expect the turbulence in 2023 was as challenging as ever.

As of this writing, our industry is grappling with the fallout of the alleged fraud linked to ILS insurtech Vesttoo. The full details and implications are yet unknown, but it seems likely that the event will have a lasting impact on the program space.

Fronting and hybrid carriers have proliferated in recent years and play a vital role in our ecosystem. The capital and capacity that support premium writings in these carriers is sometimes opaque, and in the case of Vesttoo, historically untested.

As the industry works through the full scale and scope of the Vesttoo collapse, the fronting model could see more scrutiny from AM Best and regulators, and a flight to more established or traditional reinsurers could result in tighter capacity and less favorable terms and conditions for program administrators during upcoming renewals, among other reverberations.

The success of the program industry is often attributed to an entrepreneurial spirit and innovative approach that are hallmarks of many program administrators and their carrier partners. While the Vesttoo collapse may leave lasting scars, it’s reasonable to believe that our industry will adapt and evolve to continue providing innovative, comprehensive solutions to customers and partners.

The level of professionalism and competency and the quality of the talent in the program industry are at all-time highs. There’s no place better to witness this than at the TMPAA annual conference where industry leaders come together to address opportunities and challenges that make program business the most exciting place to be.

Conclusion

The program business landscape’s expansion and evolution, mirrored by the TMPAA’s growth and strategic initiatives, encapsulate an industry on the cusp of transformation. Navigating challenges, seizing opportunities, and fostering collaboration, the future promises a thriving program business ecosystem driven by the dedication, innovation, and resilience of its leadership and members.

The author

Ray Scotto is executive director of the Target Markets Program Administrators Association.